By Richard Thomas

IN THE age of the Internet and social media, responses to developments, incidents and accidents around the world are having increasingly rapid reflection in the value of shares and stocks.

An Ethiopian Airlines 737 Max 8 bound for Nairobi crashed after take-off from Addis Ababa on the morning of Sunday, March 10, killing all 157 people on board. Over the course of the next two days, aviation authorities in Singapore, Australia and the United Kingdom all banned the Max 8 737s from their airspace.

Airlines around the world were split between those who have grounded their Max 8 fleet and those continuing to fly — while keeping in constant touch with Boeing. The partial grounding of Boeing’s aircraft is the sort of incident which could be expected to hit the corporation’s stock price — and it did.

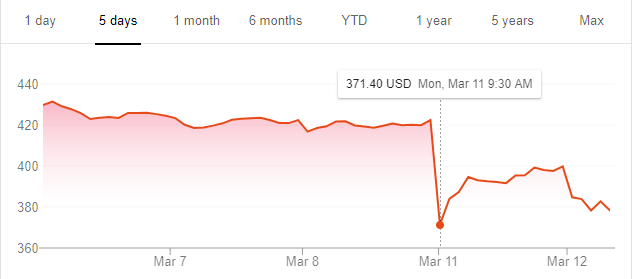

More surprising is the fact that the stock price had already begun to reel in the hours following the disaster. On Monday, shares in Boeing on New York Stock Exchange opened 12 percent lower than their closing value on Friday. By the end of the day they had regained some of that loss, but still closed five percent down.

More surprising is the fact that the stock price had already begun to reel in the hours following the disaster. On Monday, shares in Boeing on New York Stock Exchange opened 12 percent lower than their closing value on Friday. By the end of the day they had regained some of that loss, but still closed five percent down.

Sunday’s tragedy was not the first to affect the latest incarnation of the familiar Boeing 737. An Indonesia Airlines Max 8 crashed shortly after take-off from Jakarta just five months before, on October 29, 2018. Until that time, Boeing’s share value had been steadily rising since Sept 2016. There was more variation through 2018, but the value really started to fall at the end of October.

The market also reacts favourably to positive news. On December 12, the CEO of United Airlines, Oscar Munoz, gave the Boeing aircraft under investigation his vote of confidence. There had been speculation that instrumentation had given pilots incorrect information leading up to the October crash, but Munoz said pilots were taught to disconnect automated systems, fly the plane by hand and gain altitude to buy time. “When any trouble arises, our pilots are trained to fly the damn aircraft, period,” Munoz told reporters. Nine days later, on December 21, a Brazilian judge overturned an injunction that had blocked the partial takeover by Boeing of Brazilian aircraft manufacturer Embraer.

Following these announcements, from December 24, the share price started to climb. That rise lasted until March 1, when some commentators questioned the strength of Boeing’s financial data.

At the time of writing, the flight recorders from the Ethiopia crash have been found, but investigators are still looking for the cause. The official line (from the US government) is that the aircraft is safe and reliable. Other governments, airports and airlines around the World tend to err on the side of caution until more data is available.

Boeing’s share price has levelled off but is still lower than it was on the Friday prior to the accident in Addis Ababa. Its future is likely to remain linked to further assessments of its safety.

| Boeing | BA 197.71 -2.24 -1.12% |