Nearly all financial and commodity markets stumbled in 2018. Canada-based STUART DUNN, chairman of the Holdun Family Office, looks back at a year some would rather forget.

(Click here to see financial data for market indexes mentioned in the article)

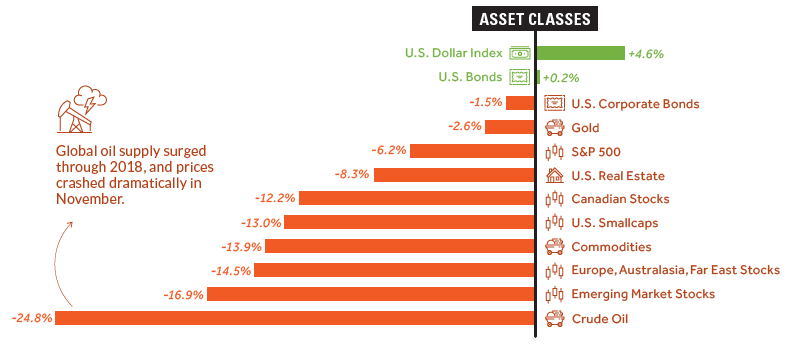

EXCEPT for a modest gain in cash and a flat performance for a broad measure of US investment grade bonds, last year was awash in red ink.

Stocks in emerging markets suffered the biggest retreat among the major asset classes, tumbling 14.6 percent. In the US, Wall Street started the year strong, buoyed by a growing economy and corporate profits; it didn’t end that way. Stocks reached new highs in January and rode a wave of tax cut-induced corporate earnings growth to another all-time high by September.

Then the jitters set in.

Investors grew worried that the testy USA-China trade dispute and higher interest rates would slow the economy, hurting corporate profits. In October, the market sold technology companies and other growth sectors in favour of less risky assets, such as government bonds.

The autumn sell off knocked the S&P 500 down 10 percent from its record high. The index ended the year with its worst annual performance in a decade, losing 6.2 percent.

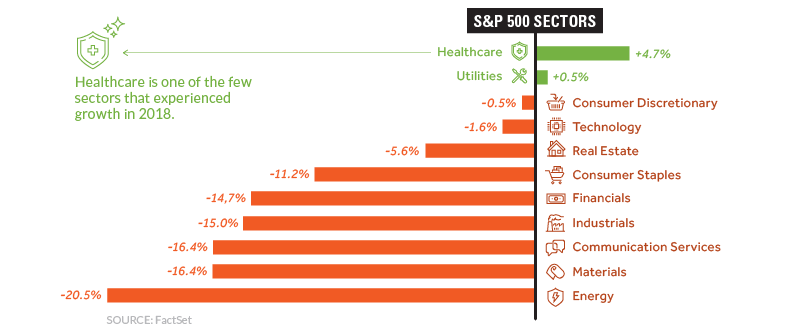

Energy, materials, communication services, industrials and financials were the biggest percentage losers. Only healthcare and utilities ended the year higher than they began it.

In Canada, the TSX fell 11.6 percent for the year after declines that started in the summer gained momentum. Trade disputes and slowing global growth stoked fears of a recession. The main laggard in Canada was the energy sector (-21.5 percent) as oversupply caused volatility in oil prices, particularly throughout November. On the other hand, technology stole the show with returns up by 12.5 percent.

Consumer staples, the only other Canadian sector in the green, posted a modest gain of 0.6 percent over the year.

Consumer staples, the only other Canadian sector in the green, posted a modest gain of 0.6 percent over the year.

Major indexes in Europe also ended 2018 in the red. The CAC 40 of France finished the year down 11 percent. Britain’s FTSE 100 lost 12.5 percent. Germany’s DAX ended in a bear market, down 22 percent from a high in January – and 18 percent from the start of the year.

In Asia, the Year of the Dog was not kind to Chinese stocks. The Shanghai Composite declined 24.6 percent, its worst performance since 2008. As shares on the mainland were pummelled, Hong Kong performed a bit better, with stocks declining only 13.6 percent. Japan’s Nikkei ended the year with a loss of 12 percent.

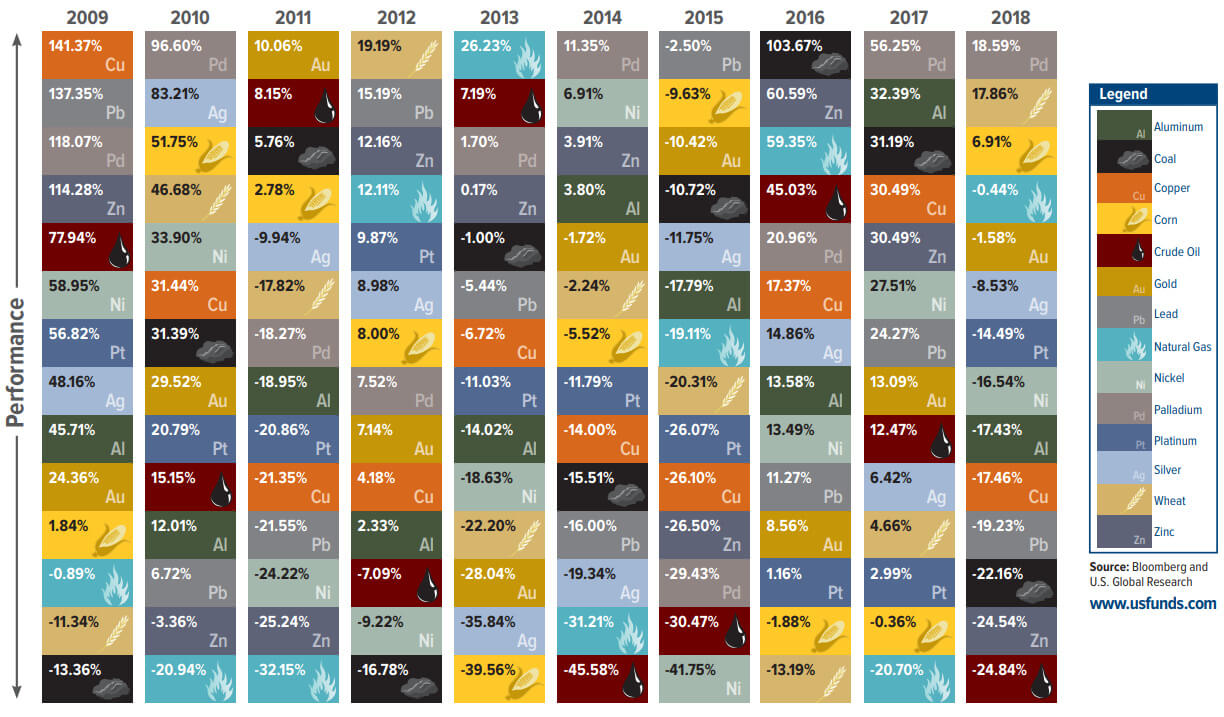

Most commodities experienced a bad year – with oil among the worst performers.

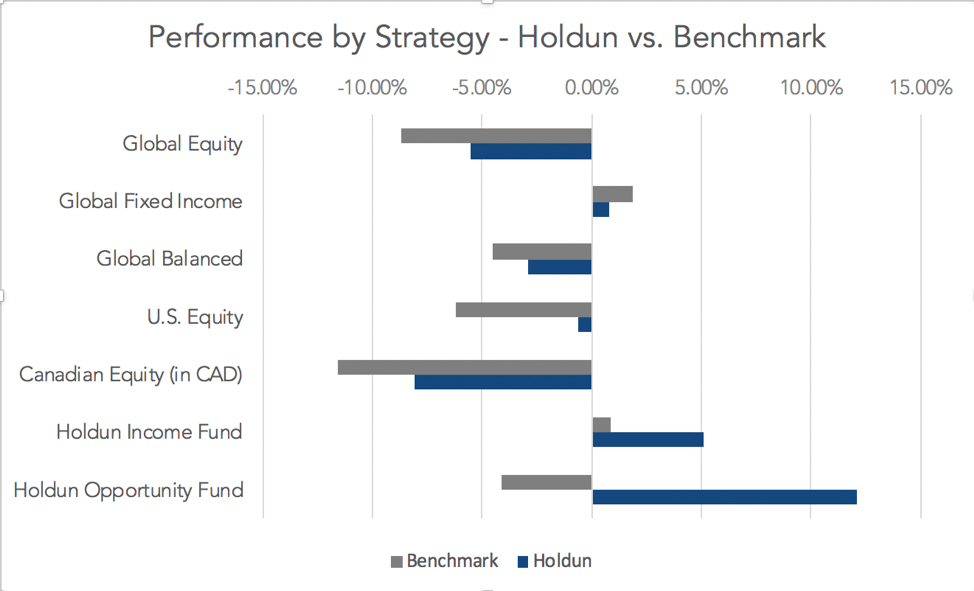

Some individual companies managed to buck the negative trend. The Holdun Canadian Equity may have lost 8.1 percent, but it outperformed the S&P TSX. Stock selection was a value-add to its relative outperformance.

During the same period, the Holdun US Equity was relatively flat with modest losses of 0.6 percent, but it outperformed its benchmark. In the US markets, volatility throughout the fourth quarter erased all-time highs seen in Q3.

During the same period, the Holdun US Equity was relatively flat with modest losses of 0.6 percent, but it outperformed its benchmark. In the US markets, volatility throughout the fourth quarter erased all-time highs seen in Q3.

Stock selection was primarily a value-add to the family office’s relative outperformance within the US portfolio. The Holdun International Equity strategy posted a loss of 5.5 percent, outperforming its benchmark during 2018.

Global economic growth is likely to lose steam, but a recession in 2019 remains unlikely. Nonetheless, uncertain monetary policy, combined with heightened geo-political risk, increased equity volatility. That will continue in 2019.

A balanced portfolio still offers a compelling risk-reward profile. Holdun will view any equity market correction as an opportunity to add further risk assets.

| S&P 500 | ^GSPC 3,019.80 -70.43 -2.28% |

| S&P/TSX Composite index | ^GSPTSE 15,188.98 -257.16 -1.66% |

| CAC 40 | ^FCHI 4,909.64 -8.93 -0.18% |

| FTSE 100 | ^FTSE 6,159.30 +12.16 +0.20% |

| DAX | ^DAX 11,401.13 -91.53 -0.80% |

| Shanghai Composite | ^SSEC 2,979.55 +8.93 +0.30% |

| Hang Seng | ^HSI 24,549.99 -231.59 -0.93% |

| Nikkei 225 | ^N225 22,512.08 +252.29 +1.13% |