The fiscal contribution of MNEs (multinational enterprises) has been at the centre of attention for some time. Numerous instances of well-known firms paying little or no taxes in some jurisdictions despite obviously significant business interests have led to public protests, consumer action, and intense regulatory scrutiny. Action groups and non-governmental organisations (NGOs) have brought to light cases of abusive fiscal practices of MNEs in some of the poorest developing countries.

Broad support in the international community for action against tax avoidance by MNEs has led to a G20 initiative to counter BEPS (base erosion and profit shifting), led by the Organisation for Economic Cooperation and Development (OECD), which is the main (and mainstream) policy action in the international tax arena at the moment.

The formulation of the post-2015 development agenda and the financing needs associated with the SDGs (sustainable development goals) have added to the spotlight on the fiscal contribution of MNEs as an important source of revenue for governments and a crucial element of resource mobilization for sustainable development.

However, the SDG formulation process has also highlighted the need for increased private sector investment. The World Investment Report 2014 showed how public investment will be insufficient to cover an estimated $2.5 trillion annual investment gap in developing countries in productive capacity, infrastructure, agriculture, services, renewables, and other sectors. New private investment not only contributes directly towards progress on the SDGs, but also adds to economic growth and the future tax base.

The key question is thus: how can policymakers take action against tax avoidance to ensure that MNEs pay “the right amount of tax, at the right time, and in the right place” without resorting to measures that might have a negative impact on investment?

Much of the attention of the public and of policymakers focuses on the way MNEs structure their investments through so-called conduit structures in jurisdictions that offer certain fiscal advantages for cross-border investors, such as large treaty networks for the avoidance of double taxation, tax rules that allow profits to be transferred into or out of the country at no cost, or commercial rules that enable corporate structures for the management of international operations. They can be called “investment hubs” in a hub and spoke system of international corporate investment.

UNCTAD’s World Investment Report 2015 (WIR15), on the one hand, shows that offshore investment hubs can have significant negative side-effects. FDI (foreign direct investment) channelled through hubs tends to lead to lower tax revenues from the operations of MNEs in both home and host countries.

On the other hand, UNCTAD’s analysis also shows that offshore investment hubs currently play a systemic role in international investment flows: they are part of the global FDI financing infrastructure. Such a large part of cross-border investment flows through hubs that any measures at the international level that might affect the investment facilitation role of these hubs or that might affect key investment facilitation levers (such as tax treaties) should include an investment policy perspective.

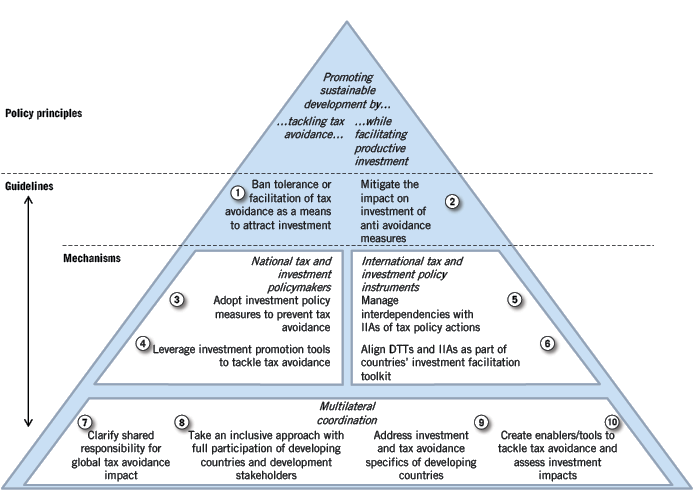

Ongoing anti-avoidance discussions in the international community pay relatively limited attention to investment policy. WIR15 proposes a set of guiding principles for coherent international tax and investment policies that can help realise the synergies between investment policy and initiatives to counter tax avoidance. Synergistic international tax and investment policymaking should aim to:

- Remove aggressive tax planning opportunities as investment promotion levers

- Address the potential impact on investment of anti-avoidance measures

- Take a partnership approach to tackling tax avoidance in recognition of shared responsibilities between host, home and conduit countries

- Manage the interaction between international investment and tax agreements

- Enhance the capabilities of developing countries to address tax avoidance issues

- Strengthen the role of both investment and fiscal revenues in sustainable development