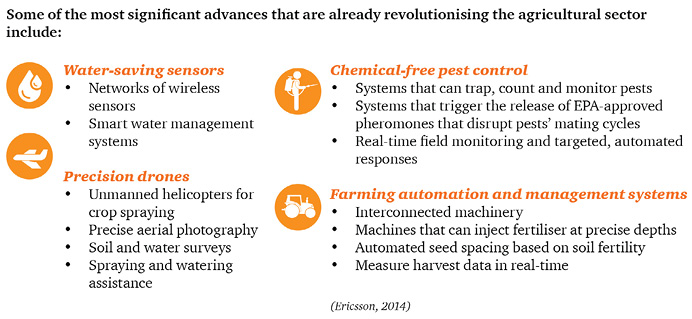

Currently, agriculture is standing on the edge of a second green revolution. This revolution will entail fundamental shifts in how the agricultural sector uses and implements innovative technology to improve output in a sustainable manner and address the need for greater food security globally.

Currently, agriculture is standing on the edge of a second green revolution. This revolution will entail fundamental shifts in how the agricultural sector uses and implements innovative technology to improve output in a sustainable manner and address the need for greater food security globally.

Annually, PwC produces a publication for agribusinesses in Africa with insights gained from agribusinesses CEOs working in Africa. While the Africa Agribusiness Insights Survey 2016 provides insights into the strategic challenges that CEOs face in their agribusiness, it also highlights areas where technological innovation is already taking place and where it can make a difference in the future. In addition, the survey provides viewpoints on the agricultural sector in South Africa, Nigeria and Kenya.

Africa’s economic performance over the past decade has been remarkable, showing an average growth rate of 5%. If this growth rate is maintained, projections indicate that Africa’s GDP could increase approximately threefold by 2030. The agricultural sector is regarded as one of the most critical industries for the African continent due to its economic potential. According to the World Bank, it may potentially become a $1 trillion industry in sub-Saharan Africa alone by 2030.

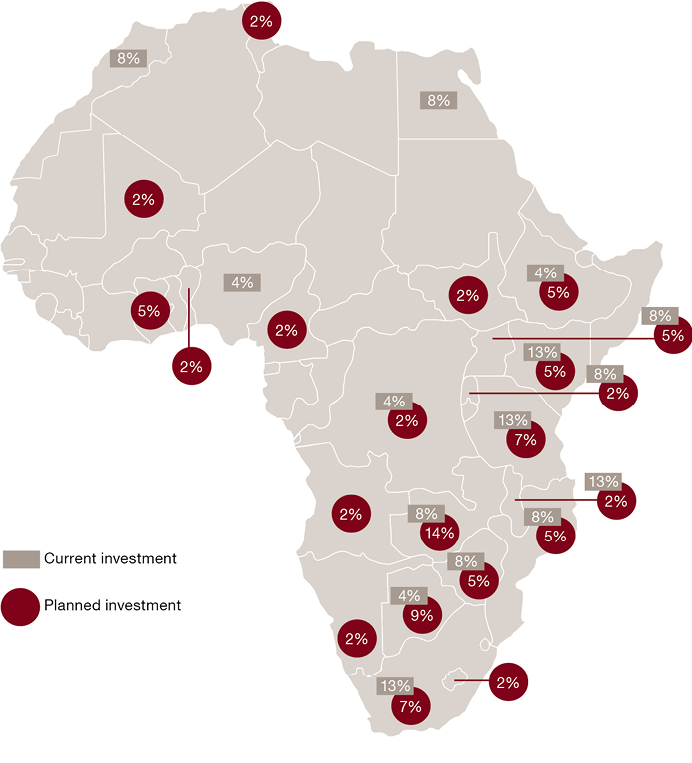

New geographical markets are seen as opportunity by agribusiness owners for business expansion. More than half of respondents (58.8%) taking part in the survey consider investment in Africa as an opportunity for their businesses to expand. The top four countries they are planning to invest in are Zambia, Botswana, Tanzania, and South Africa. However, agribusiness owners also cited a number of challenges to cross-border expansion into Africa. These include: inefficient and bureaucratic governments; policy instability; corruption, crime and theft; and cross-border regulatory requirements.

As for expectations regarding revenue growth, survey respondents are less optimistic about their growth over the next twelve months compared with their expectations a year ago. The majority of agribusinesses (46.2%) are expecting revenue growth of between 0-5%, and 26.9% of businesses expect it to be between 6-10%.

The biggest challenges to business growth cited by business leaders were access to technology, the scarcity of natural resources and supply-side uncertainties. African agribusinesses also feel that there is a long way to go toward better support from government in the sector. For example, businesses are of the view that government does not offer sufficient tax incentives to ensure international competitiveness. Furthermore, they say government is not doing enough to develop skilled workers in the sector.

African agribusinesses also indicated they have maintained focus on risk management, with the majority of survey respondents (95.2%) periodically conducting a formal risk assessment. It is also positive to note that 53.8% of respondents prepare an integrated report.

Human resources (HR) models and processes are beginning to evolve, with more emphasis being placed on technology to improve networks and data. Agribusinesses are looking to their HR teams to provide not only basic services and transactional activities but also strategic insights and workforce intelligence. Businesses indicated internal HR capacity, labour unrest, employee turnover, and communication between employees and management as the most challenging human resources matters.

Consensus

Although there is widespread consensus on the reality of global climate change, much uncertainty still exists when it comes to the exact measurable impact of changes in climatic conditions on agriculture and food security. This makes it all the more critical for the agricultural sector to take climate change seriously.

Although there is widespread consensus on the reality of global climate change, much uncertainty still exists when it comes to the exact measurable impact of changes in climatic conditions on agriculture and food security. This makes it all the more critical for the agricultural sector to take climate change seriously.

The majority of agribusinesses are of the view that climate change will have a significant impact on SSA agriculture in the future – 41.2% indicated that there will be a significant impact in the short term and 35.3% that there will be an impact over the next twenty years. Agricultural activities can perpetuate climate change due to the resulting emission of greenhouse gases.

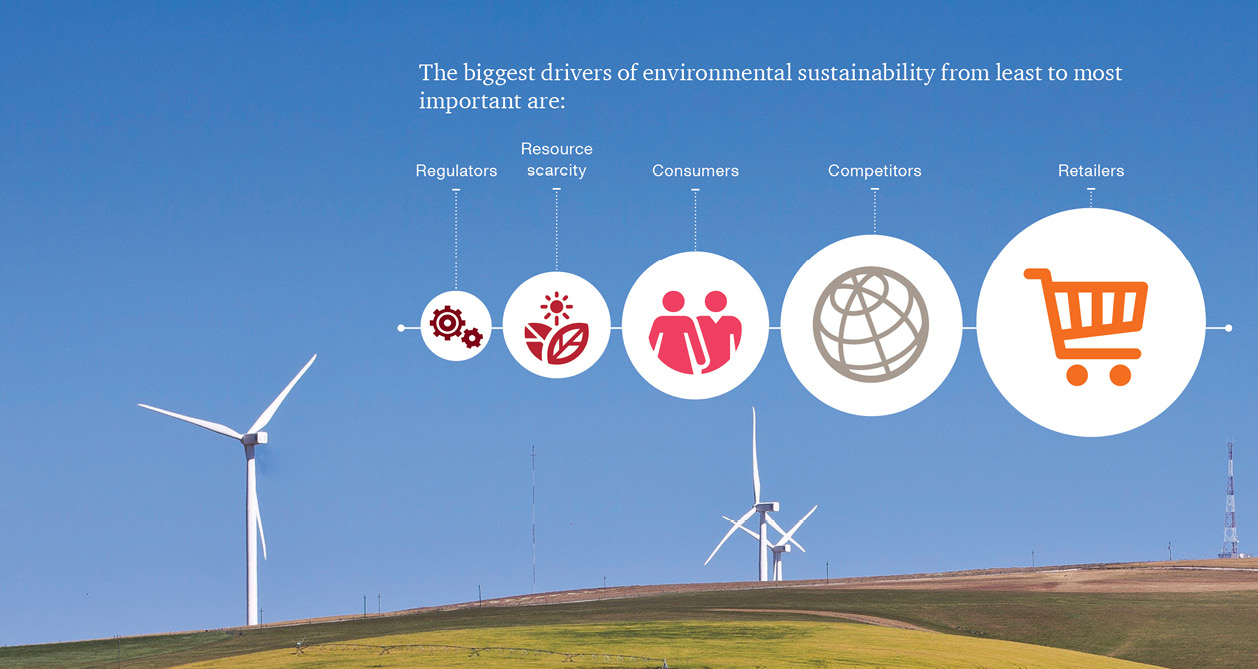

However, there is an increasing focus on agriculture’s positive contribution to mitigating climate change through carbon sequestration and, for instance, the substitution of biofuels for fossil fuels. These contributions will hopefully increase in the near future, with a stronger focus on mitigating strategies in the developing world. In addition, 35.3% of agribusiness leaders indicated that they are considering investment in renewable energy, while 29.4% have already done so. The main forms of renewable energy that agribusinesses have invested in are solar energy and biogas.

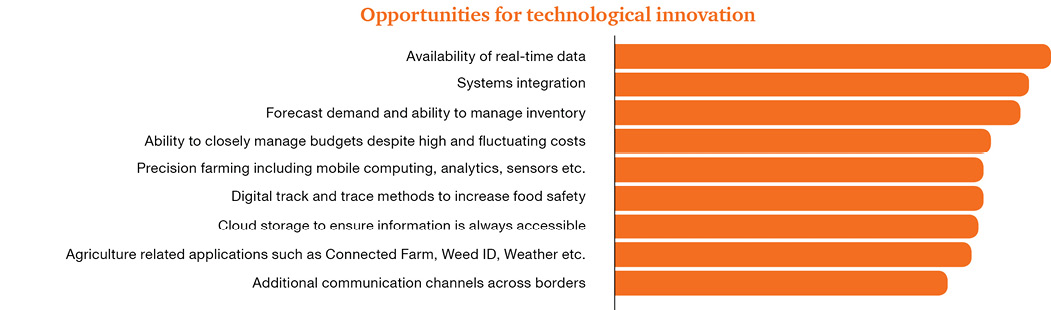

Increased pressure on the profitability of farming and agricultural business activities is forcing the agricultural sector to be an early adopter of new technologies in order that it may improve the productivity and profitability of the sector. Survey respondents noted the availability of real-time data as the biggest opportunity for technological innovation. The agricultural industry is reaching a level of precision that was almost unimaginable a decade ago. With the existing technologies in place, the availability of real-time data could provide more efficient decision-making and a proactive farming approach that can be tremendously valuable.

According to the survey, drones coming from military aviation technology are fast becoming a real green-tech tool. Real-time aerial data is obtained through precision drones, and significant time and cost are often saved in the process of managing large portions of land in this way. It is estimated that the addressable market of drone-powered solutions in the agricultural industry is $32.4 billion, according to PwC research.

AIFarming

Global studies also show that artificial intelligence (AI) farming will be the main enabling factor in increasing the world’s agricultural production capacity to meet the demands of the growing population. This goes hand in hand with precision farming and other technology trends. The majority of survey respondents (76.5%) agree that AI farming will make a major contribution to increasing capacity in Africa over the next ten years. Only 47% of businesses had already invested or plan to invest in the development of AI farming capabilities for primary production. This could be due to the cost of implementation, which was noted as the biggest restriction to the use of AI farming capabilities (64.7%).

All agribusinesses indicated that they felt a responsibility towards food security. Food quality and safety is the one pillar of food security that respondents indicated they can contribute towards the most followed by availability and affordability. It is also positive to note that all businesses indicated their agribusinesses contribute towards corporate social investment (CSI). The top three areas of investment are: healthcare, education and personal improvement.

It is predicted that technological innovation will act as a catalyst in lifting agribusiness to the next level in Africa. To sustain growth, it is critical that the agricultural sector adapts to change through agility and absorption, and that agribusinesses have strategies in place that deal with current as well as expected future trends. The winners will be those agribusinesses that seize the opportunity to create new opportunities through technology – they will be able to reach their strategic goals faster and more efficiently.

About the Author

Frans Weilbach is a partner in PricewaterhouseCoopers’ African firm. He is based in the Stellenbosch office in South Africa’s Western Cape Province.

Frans Weilbach is a partner in PricewaterhouseCoopers’ African firm. He is based in the Stellenbosch office in South Africa’s Western Cape Province.

Mr Weilbach is PricewaterhouseCoopers’ agribusiness industry leader for Africa. He has been the author of many agribusiness survey publications including PwC’s Agribusinesses Insights Surveys over many years. He regularly contributes articles to various agricultural publications and present at conferences and discussion groups.

Over many years Mr Weilbach has worked with businesses and other players in the sector on corporate and other transactions. He is an advisor to a number of agribusinesses in the region. Mr Weilbach has also been the PricewaterhouseCoopers’ South Africa firm’s wine sector specialist for many years and is one of the global anchors for PricewaterhouseCoopers’ International Wine Industry Network.

Mr Weilbach is also one of PricewaterhouseCoopers’ South Africa firm’s assurance directors for public (listed and unlisted) and private companies. He has held this position for more than sixteen years. His clients include large and small agribusinesses, agro-processors, retailers, manufacturers, and South African groups with foreign private equity owners